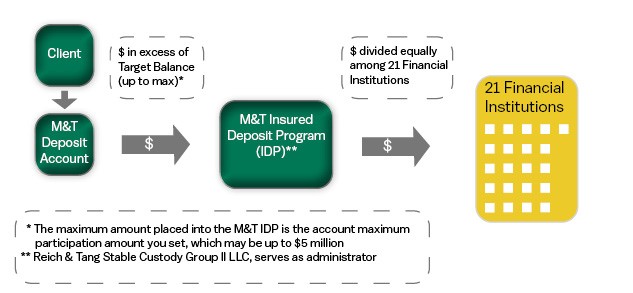

M&T Insured Deposit Program

Get access to a network of financial institutions that, together, can offer millions of dollars of FDIC insurance coverage and liquidity. Plus, you'll get the convenience of working directly with M&T as your single point of contact.

Convenient, insured cash management solution.

How the Insured Deposit Program works:

Please contact your Relationship Manager, Treasury Management Consultant or call M&T's Treasury Management Service Team at 1‑800‑724‑2240 (option 2, option 4), Monday-Friday, 8am‑6pm ET.

FAQ's

Who is eligible to participate in the program?

M&T makes this program available in its discretion to commercial clients with a current agreement for M&T Treasury Management services and a checking account.

*Cannot have another investment sweep on identified account

**Government, Broker-Dealers and Financial Institution clients are ineligible for this service and M&T reserves the right not to provide this service to any client.

What is the maximum amount that my company can place in the program?

$5 million per TIN/EIN.

Is there a service charge to participate in this program?

There is no monthly service charge to participate in this program.

How does interest accrue? When does interest get paid?

Interest will accrue daily and post monthly to the linked account.

Is the interest rate on the program negotiable?

No. All funds placed in the program through M&T will earn the same rate of interest.

What happens to the funds that stay in the DDA (not in IDP)?

You will continue to earn your existing earnings credit rate or interest rate.

How do I view balances in Treasury Center?

For previous day reporting- balances can be found in the Investment Sweep section.

For current day reporting- balances will show as a memo credit in the amount of your IDP sweep.

Please work with your Treasury Management Consultant to turn on IDP Reporting in Treasury Center.

Will I get a statement?

Yes, you will receive a combined monthly statement.

What banks are included in the program?

Financial Institution* |

FDIC Cert # |

Bell Bank |

19581 |

BOK Financial |

4214 |

Bravera Bank |

22559 |

City Bank Texas |

25103 |

Comenity Capital Bank |

57570 |

Comerica Bank |

983 |

First Business Bank |

15229 |

Forbright Bank |

5229 |

Georgia Banking Company |

57071 |

Kearny Bank |

38765 |

Luther Burbank Savings |

32178 |

Meridian Bank |

57777 |

Metropolitan Commercial Bank |

34699 |

Peapack Gladstone Bank & Trust |

11035 |

Renasant Bank |

12437 |

River City Bank |

18983 |

Sallie Mae Bank |

58177 |

SoFi Bank |

26881 |

The Washington Trust Company |

23623 |

Umpqua Bank |

17266 |

Wintrust Bank, NA |

33935 |

What if my company already has money at one of these participating financial institutions?

Unfortunately, we cannot exclude any of the participating financial institutions in the program.

If the total balance at one of the participating financial institutions, including the funds part of IDP, exceeds $250,000 then the excess deposits will be uninsured.