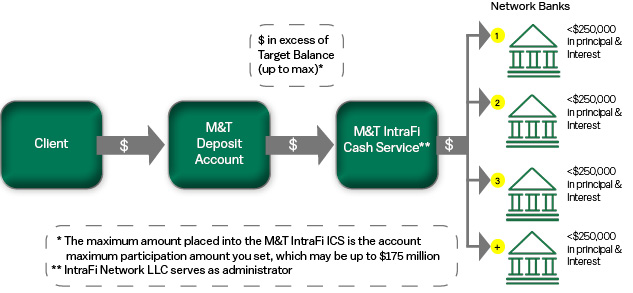

M&T IntraFi Cash Service

Get access to a network of financial institutions that, together, can offer millions of dollars of FDIC insurance coverage. Plus, you'll get the convenience of working directly with M&T as your single point of contact.

Convenient cash management solution to expand FDIC insurance.

FDIC Insurance Coverage

Access up to $175 million in FDIC protection.

Daily Liquidity

Funds are available daily to cover disbursements{{d1130*}}

Diversification of Deposits

Reduced deposit exposure through diversification among participating FDIC-insured financial institutions.

Single Point of Contact

Avoid the burden of dealing with numerous banks.

Depositor Control Panel (DCP)

Secure website specially created for you to view your deposits.

How the M&T IntraFi ICS Program works:

Please contact your Relationship Manager, Treasury Management Consultant or call M&T's Treasury Management Service Team at 1‑800‑724‑2240 (option 2, option 4), Monday-Friday, 8am‑6pm ET.

FAQs

Commercial clients with a current Treasury Management MSA and Resolution, that have a Checking, Money Market, or Savings account. Business Banking clients may be eligible with M&T approval. Retail accounts are not currently eligible for the program.

Other limitations apply, including (1) The client cannot have another investment sweep on the identified account; (2) the client cannot be enrolled in an IOLTA, IORETA, or another account designed to hold client funds.

$175 million total per TIN/EIN. The main M&T IntraFi ICS product (Demand) has a maximum of $135 million per TIN. In order to reach the $175 million, a secondary product (M&T IntraFi ICS Savings) would need to be opened. The maximum for the ICS Savings product is $40 million. A client can have multiple accounts in either program and have both programs in place under one TIN. However, any given account can only be set up in one product.

Please contact your Relationship Manager or Treasury Management consultant for details.

If your originating M&T account is interest-bearing, you will continue to accrue interest through that account until the funds are removed at end of day. The next business day your funds will be deposited into the M&T IntraFi ICS program account, and you will begin to accrue interest daily through the program. Interest will be posted monthly to the linked M&T account. The program account functions on a one-day lag for all deposits and withdrawals, and therefore, interest accrued in the network is on a corresponding one business day lag.

In rare cases, you may be paid interest early. This can happen if you leave the program or your cash moves to a different bank within the program.

The interest rate is tiered based on the account-level balance in the program. Speak to a Treasury Management Consultant for details.

You will continue to earn your existing earnings credit rate or interest rate.

For Government Entities, the funds remaining in your originating M&T account will continue to be collateralized to the same extent they are today.

For previous-day reporting, balances can be found in the Investment Sweep section.

For current-day reporting, balances will show as a memo credit in the amount of your ICS sweep.

Yes, a monthly electronic statement by TIN for your M&T IntraFi ICS accounts will be available for download on the Depositor Control Panel.

In addition, we will continue to send you a copy of your M&T Commercial Statement in the same manner and frequency as it is currently sent.

Visit https://www.intrafi.com/network-banks for a complete listing of IntraFi network banks.

Only FDIC-insured institutions are eligible to hold M&T clients' funds.

IntraFi Network LLC is the vendor that we partner with for the M&T IntraFi Cash Service program. To learn more about them please visit their website:

Placement of funds is systemically controlled by the vendor, and you will not have the ability to set preferences. However, you can exclude banks with whom you already have depository relationships to avoid exceeding FDIC insurance limits at those institutions.

You can exclude those institutions using the Deposit Agreement when signing up for the program or through the Depositor Control Panel platform at any time.

The institutions can be viewed in the Depositor Control Panel platform.

The Depositor Control Panel is a secure website where you can view your M&T IntraFi ICS accounts.

You will receive access instructions from M&T when you are setting up your participation in the program.

Treasury Center will reflect all balance changes in the originating M&T account on the same day.

The Depositor Control Panel platform is updated at 5 pm ET each business day. When comparing DCP balances to Treasury Center or DDA Statements, any balance changes will be reflective of the prior business day’s activity on your M&T account.

Treasury Center reflects balances effective the day that we sweep the funds to/from the linked account. The IntraFi program does not allocate the funds into the network until the following business day. Therefore, any program deposits or withdrawals will be posted effective the business day they are received into the program, which is typically a one-business-day lag.